Today, we have the opportunity to present an innovative project to you. A project which aims to support and finance the Kurdish community in any aspect, collectively, periodically and automatically.

A quick summary :

To summarize, we have managed to create a stake pool for the Kurdish community on the cardano blockchain, named Kurdopia. Stake pools are necessary pillars which help maintain and secure the cardano network infrastructure. The cardano blockchain is a decentralized system that allows the transfer of value, such as money, without intermediaries. A stake pool in the system verifies and validates blocks of transactions. For a stake pool to be elected to verify and validate a block, it must have in its possession a certain amount of a resource, i.e. virtual currency called Ada, of the Cardano ecosystem. The more ada a stake pool has, the more likely it is to be elected as a block validator. Each block brings rewards (ada) to the operator and the participants of a stake pool. Not every person has the skills or means to create and operate a stake pool, but each person can easily buy ada and become a delegator, by delegating ada to an existing stake pool. A delegator does not give his or her funds to the stake pool, he or she delegates his/her weight of influence as a voter, with the amount of ada he/she has. The stake pool and its delegators earn rewards, according to their share of delegation (stake), when the stake pool is elected to create a new block. You can invest in cardano and delegate to Kurdopia stake pool. One can earn a passive income of around 5,5% per year while supporting the Kurdish community. You will learn more on this in the following article.

A quick observation of our community :

In more than 50 years of continuous Kurdish migration to Europe, the Kurdish community is still left behind, marginalized and neglected. Kurdish language courses are still rare to find. By contrast, languages such as Arabic, Portuguese, Italian, Turkish, Croatian and Serbian are taught in certain public French schools as part of « languages and cultures of origin » program since 1977.

We can ask ourselves : where are the schools or universities that teach Kurdish ? Where are the multinational Kurdish firms ? Where are the Kurdish restaurant franchises ? Where are our help and integration organizations for immigrants and families in difficulty ? Where are the Kurdish lobbies ?

Our history and our current situation show us that we were not able to evolve or adapt in an advantageous manner as the other nations. Indeed, while the others devoted themselves to building their homelands, our ancestors did not know how to unite and organize themselves, or did not find interest in it before it was too late. Now, it’s up to us not only to catch up, but also to evolve ahead of others.

The traditional means of activism such as demonstrations, boycotts or social media campaigns are interesting to be heard locally and temporarily, but insufficient to efficiently advance the cause. We must learn to rely on ourselves and find alternatives in order to achieve our end goals. This happens through trust, organization, solidarity and education without affiliation to political parties.

It is also encouraging to observe more and more initiatives on behalf of the Kurdish youth, a desire to participate in the development of the community. Why not use our individual knowledge and skills for the common good ?

The general idea of the « Kurdopia » project:

The final goal to keep in mind is to be able to support Kurds in general, all over the world, but starting with the diaspora. It is essential that the Kurds in the diaspora organize themselves and gain influence, political and social, so that they can subsequently provide assistance to the Kurds in Kurdistan. It seems to us that this occurs through investment in Kurdish projects and by enriching the community. By this, it is important to understand, to « enrich » not just yourselves, but for the good of the community.

In order to achieve this, we imagined an investment fund, or more of a crowd funding « collective pot », to finance Kurdish companies, organizations, associations, projects and ideas.

Let’s take an example to better illustrate the idea. Imagine you want to open a Kurdish business (a restaurant, a construction firm, a charity or anything else). Imagine you have the will and the skills, but you don’t have the means or the relations. The banks don’t want to finance you, or you are even afraid to take the risk of applying for credit, simply because you are afraid of failure.

There are around a million Kurds in Germay. Mathematically speaking, if only a quarter participated in a donation of 1€ per month, that would make about 250 000 euros per month. A « collective funding pot » that you could then solicit by formulating a request and presenting your project or your needs to the committee which will eventually be formed or to the community which could vote.

Now let’s imagine the donor’s side. The first problem we face, of course, is trust. Why would you give anything to an entity that you know nothing about?

Of course, we know that lack of confidence is even more relevant among the Kurds, who are rightfully suspicious considering their history. As a result, we have taken this distrust specifically into account in developing this project. We will show you later how this project solves this problem, to arrive to a win-win situation so that everyone is a stakeholder and not just the direct beneficiaries.

Then, let’s consider the donation system itself. Imagine you do not want to give 1€, but you agree to give less, for example micro-donations of 5 or 10 cents periodically in an automated manner and not only from Europe but from any other country in world.

What is described above is difficult to put in place with the current banking system (a controlled and centralized system). The transaction fees will be higher than the amount you want to donate not to mention other issues, such as taxes, bank refusals of micro-payments, conversion fees, regulations, etc.

However, there is already a system that solves all the problems mentioned above and much more. A system that is operational and that we have been using for our project since August 2020. Indeed, we are going to explain it to you and present to you some concrete figures below.

Presentation of the blockchain technology and Cardano :

Before that, we need to introduce some technical terms for the explanation. Don’t be afraid if you don’t understand the all the terms at first or how it all works. The most important thing is that you understand what it is used for. By analogy, explaining the system in question and how it works is equivalent to explaining how the internet works. Most of you probably don’t understand all the components, algorithms, programs, cryptographies or the mathematics that make the internet possible, but you use it all the same without much difficulty. The same goes for your smartphone or your car. You don’t have to understand the whole mechanism of a system to understand its utility.

The system we are referring to is the blockchain, more specifically the Cardano blockchain.

First of all, what is a blockchain?

You will see that the « blockchain » technology, a new term that might seem unfamiliar to you now, is in fact easier to understand than you think.

Imagine a virtual accounting book or in other words a virtual « ledger » with all past transactions. Then imagine that a copy of this virtual ledger is distributed and shared over a public network that has a few thousand computers. With each new data entry or transaction, these thousands of computers work together to keep this ledger up to date. This avoids having a central authority that controls and governs. By this simple fact, the blockchain is a decentralized network with a decentralized database.

When you carry out a transaction from your address to another on the blockchain, it is transmitted through the network of computers which have the same ledger with the recorded history of all passed transactions. You should know that an address is a series of letters and numbers. Thus the identities of the sender and receiver remain anonymous, but the transaction is traceable on the public network. The blockchain network is therefore more or less anonymous, but can be more or less transparent, precisely to make verification possible.

All new transactions at time « t » are recorded in a « block of transactions », which is then encrypted by a very sophisticated cryptographic algorithm. All the computers in the network update their ledger by verifying and validating the following block in the « chain of blocks », according to a well-defined and automated protocol. No data recorded in the blockchain can be falsified, or modified without the authorization (private key) of the author or without the consent of the authors. In any case, the history of each modification is recorded and traceable. No parameter within the protocol itself can be changed without the consensus of the majority of validators (thousands of computers) in the network.

To be able to hack and corrupt the blockchain it would be necessary to take control of more than half of the validating computers of the network. Which is currently impossible even with a quantum computer.

To give you an example of what this means:

Last year, Google succeeded in creating the first 53-qubit quantum computer, one of the world’s most powerful computer surpassing traditional supercomputers. Well now, imagine that it takes 1500 qubits to hack Bitcoin, which is the first and one of the most primitive of blockchains. The quantum technology needed to hack Bitcoin is therefore still a long way away. The new generation of blockchains like the Cardano are being designed to be quantum resistant.

The most important thing to keep in mind about the blockchain technology is that it is actually the evolution of the internet and thus a revolution in itself.

Indeed, the Internet allows the transfer of information (data, documents, photos, videos, music, etc.) and communication quite seamlessly, fast and more or less secure. However, when you send or share data over the internet, it is only a copy of the original. If you want to send or trade something of value over the internet, such as money, it is important not to send just a copy. Otherwise you could spend the same amount as many times as you want. It is for this reason that you must go through an intermediary, such as a bank to certify that you have the necessary funds in your account and to keep the ledger of transactions up to date.

This is true not only for money (or crypto-currencies), but for anything of value, like art, photos, videos, music, articles, documents, intellectual properties of which you are the author. Your identity, your personal data, your ownership certificate and even your vote, are of value.

Normally, it would be impossible to exchange these « objects of value » via the Internet without going through a middleman or a trusted third party such as a notary, a bank or an institution. Going through intermediaries obviously has drawbacks. This naturally leads to additional costs, slow processing time, control and traceability from a central authority. In a centralized system, someone with sufficient access could accidentally or intentionally block a transaction, change your data, or empty your account.

However, the blockchain by its decentralized and extremely secure nature makes it possible to do without a central authority. Blockchain is a system where we trust no one because we don’t need to trust someone. The trust lies within the code that is open source, which is accessible and verifiable by anyone, at any time.

The blockchain therefore allows the transfer of value between two people without intermediaries (a peer-to-peer network). Internet version 2.0, under construction!

You can watch this video which presents the blockchain technology and its potential pretty well :

https://www.youtube.com/watch?v=Pl8OlkkwRpc&t=9s

Why did we use the « Cardano » blockchain for our project ?

There are now thousands of different blockchains. To better understand our choice, we must understand the history and evolution of the blockchain technology. We must explain the three generations of the blockchain.

The first generation « Bitcoin » :

Bitcoin emerged following the 2008 financial crisis. The white paper (https://bitcoin.org/bitcoin.pdf) which describes how Bitcoin fonctions was published on a forum by an anonymous developer under the username Satoshi Nakamoto. The actual identity of the individual (or group) under this pseudonym is still unknown to this day. Satoshi Nakamoto has been missing since 2011.

Here is Satoshi’s final email sent to Gavin Andresen on April 23 2011 :

https://nakamotostudies.org/emails/satoshis-final-email-to-gavin-andresen/

You may also be interested in reading the following article :

https://fr.cryptonews.com/news/is-this-1999-forum-message-from-a-young-satoshi-nakamoto-6209.htm

The identity of Satoshi Nakamoto is ultimately of no particular importance because Bitcoin is backed by central authority and operates without its creator. We do not need to know the identity of its creator because as we have already said, the code of Bitcoin is open source. Anyone (with advanced knowledge in programming) can read and understand the mechanism behind Bitcoin. Algorithms by mathematical logic have no opinion or a hidden agenda, they are true or false, no matter who wrote them.

Satoshi Nakamoto wanted to create a decentralized universal currency, which no central authority, such as a bank or a government, could stop or control. Not only did he create a fully-fledged monetary system and means of payment, but he was also able to demonstrate, intentionally or accidentally, that it is possible to transmit anything of value via the internet, without intermediaries. In other words the blockchain, a new field in technology was born.

In the Bitcoin protocol, as we mentioned above, transactions must be verified and validated by the network of computers following a consensus. For Bitcoin, this consensus is called « proof of work », using a hash function (https://www.youtube.com/watch?v=IGSB9zoSx70). To put it in other words, computers or groups of computers try different digital keys at random to decrypt an encrypted block of transactions and then add it to the sequence of blocks. When the computer or the group of computers working together find the right key, they are rewarded with new virtual coins generated.

The more computers or more specifically the more computing power one has the more chance one has in finding the digital key to decrypt, verify and validate a block and earn rewards accordingly. However, as the total computing power of the network increases, the more the difficulty in finding the key also increases. Computers in the network provide effort, time, and consume energy (giving the network its cost value). These computers (or the people operating them) are called « miners ».

The maximum supply of Bitcoin is limited to 21 million. There never will be more than 21 million Bitcoins in existence. 18.55 million are currently in circulation, so approximately 2.45 million remain to be mined. Initially, the quantity of Bitcoins earned per block was 50. However, within the Bitcoin protocol, the rewards earned per block are divided by 2 every 210,000 blocks, or approximately every 4 years. This event is called the halving. There have been 3 halvings since the launch of Bitcoin in January 2009. The last halving occurred on May 11 2020 and currently miners earn 6.25 Bitcoins per block. It is predicted that the last Bitcoin will be mined at around the year 2140. Transaction fees will take over to reward miners down the road, so they can stay incentivized in securing the network.

We can draw an analogy with gold. Indeed, the more effort one puts into finding gold, the more effort and work one must put in to find more gold, because the resource is limited. One must dig deeper into the earth’s layer and consume more energy to find it. The quantity decreases, the demand increases and therefore the price increases accordingly.

It’s quite the same logic for Bitcoin, but Bitcoin is even more limited in quantity than gold and thus rarer. In addition, Bitcoin is easier to secure, store, transport, and faster to transfer to anyone anywhere in the world.

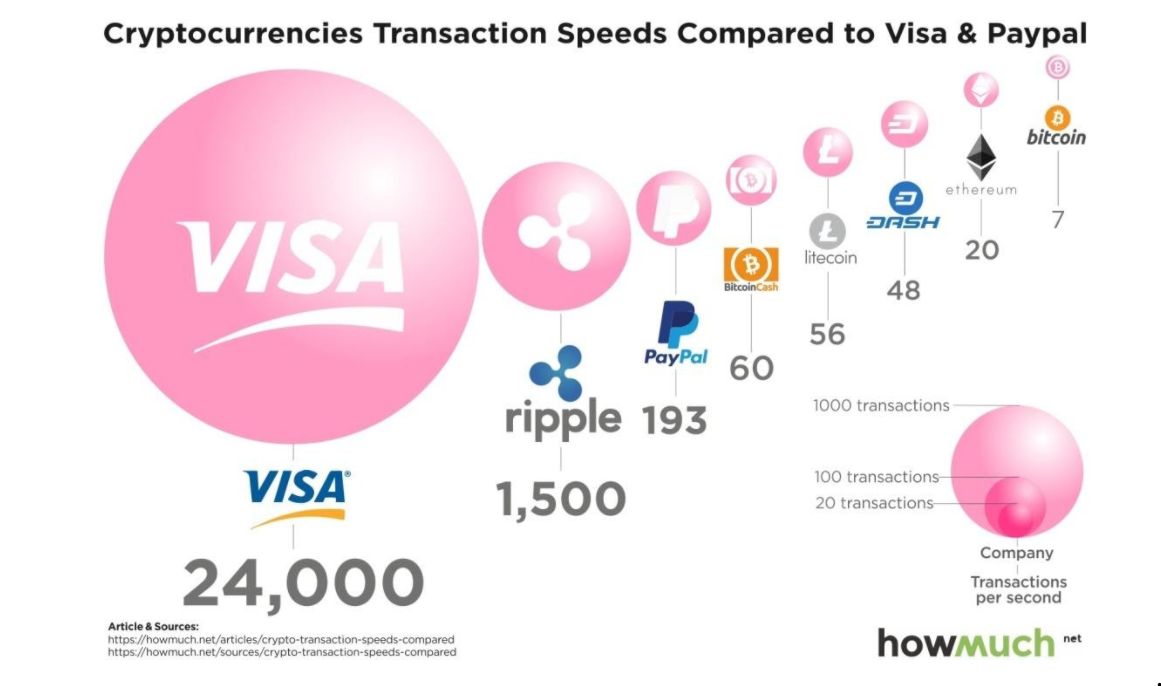

Evidently, Bitcoin being the first cryptocurrency and the first blockchain, it presents a number of problems. One of the major problems is that the entire Bitcoin network consumes as much energy as a country like Switzerland (but still less than the traditional banking system). There is also the problem of network saturation, i.e. the more users there are, the slower and more expensive the transactions become. The Bitcoin network can perform around 7 transactions per second, still slow compared to the visa card’s 24,000 transactions per second.

The hardware for mining Bitcoin is becoming more specific and expensive. Only big players with mining warehouses can afford to continue the activity and profit from it. This tends to push the Bitcoin network towards a centralization of operations, up to 65% of Bitcoins being mined by Chinese miners.

By its decentralized nature, Bitcoin also suffers from a governance problem. As a result, it is very difficult to develop or improve the Bitcoin code. When there is disagreement within the community (between miners, developers, or users) about which path to take, a split from the main blockchain branch can occur, caused by a divergence in consensus rules. Therefore, there have been a lot of splits of the Bitcoin protocol thus forming other cryptocurrencies (which one calls altcoins) like « Bitcoin Cash », « Bitcoin SV », « Bitcoin gold » and so on. This phenomenon of splitting apart from the main branch is called a « hard fork ».

A lot of altcoin projects have more or less copied the Bitcoin protocol (since it’s open source) and have tweaked some details to change or improve certain features. For example to make it a bit faster like Litecoin (LTC) or more anonymous like Monero (XMR) or Zcash (ZEC). While some sought to exploit the real potential of new technology, such as the Ripple blockchain (XRP) which seeks to reduce transaction delay and transaction fees between banks; others have created their own cryptocurrencies, simply because they could, such as Dogecoin (DOGE) which started off as a joke, but was successful nonetheless.

The second generation « Ethereum »:

A young Russian-Canadian programmer by the name of Vitalik Buterin discovered Bitcoin at the age of 17. He understood at the age of 18-19 that he could not only create a monetary system and a means of payment like Bitcoin and other altcoins, but he could also in theory make virtual currency programmable.

Thereafter, Ethereum came into existence in 2015 with the ability to program smart contracts that run autonomously. These smart contracts can be used to build one’s own cryptocurrency or tokens using the established security of Ethereum’s blockchain network, without having to rebuild a new network each time. These tokens can have various applications, such as decentralized finance, decentralized voting, decentralized insurance, decentralized VPNs, decentralized gambling & gaming, so on and so forth.

Ethereum is therefore the evolution of Bitcoin, which is not just a new monetary system, but a programmable monetary system that can host smart contracts with utility tokens for specific applications.

However, the second generation of the blockchain technology has almost identical flaws to the first generation. That is to say the problems of energy consumption and governance, the absence of communication between chains (interoperability), and more particularly, the problem of saturation or in other words the lack of scalability to allow the large-scale adoption of blockchain technology.

The third generation « Cardano »:

The 3rd generation promises to solve all of the problems mentioned above, so that the blockchain technology can finally be usable on a large scale and adopted billions of users.

What differentiates Cardano from other 3rd generation blockchains, such as Tezos, EOS, Zilliqa and Polkadot, is the scientific approach, based on first principals and on academic research which is peer-reviewed. Indeed, Cardano is product of 5 years of research, which inspired more than 90 scientific papers : https://iohk.io/en/research/library/.

The founder of Cardano is Charles Hoskinson, who is also one of the co-founders of Ethereum along with Vitalik. Three entities are working on the development of Cardano : Input Output Global based in Hong Kong, Cardano foundation based in Zug in Switzerland and Emurgo based in Tokyo. In total more than 300 employees (scientists, mathematicians, programmers, developers, engineers, etc.) work on the Cardano project.

Cardano’s platform is still under development to enable the realization of smart contracts and decentralized applications. Contracts and applications that will be used to remove intermediaries. Applications such as Atlas PRISM that will make it possible to give digital identities solutions and access to financial services to billions of people who are yet unbanked. Applications such as Atala Trace that will allow traceability and authentication of products for supply chains. These are just a few examples of the potential of the Cardano blockchain.

The development and rollout of Cardano is done in steps and phases. There are a total of 5 phases in order to solve all the problems mentioned previously. However, we are not going to explain all the phases to you, you can read about them here : https://roadmap.cardano.org/en/

We will instead focus on the phase that interests us for our project, which is the Shelley era.

The Shelley phase brings with it the security of the network through decentralization with less energy requirement. Unlike the « proof of work » protocols used by Bitcoin and other first and second generation cryptocurrencies, Cardano uses the « proof of stake » consensus protocol.

Proof of Work (PoW) demands a lot of computing power from participants in the mining process, while Proof of Stake (PoS) is based on an election process in which a validator is chosen at random to validate the next block, depending on its electoral power. The Proof of Stake protocol requires the user to prove possession of a certain amount of cryptocurrency (stake) to be eligible for election and validate additional blocks in the blockchain and to be able to receive the rewards.

A node in the network is a computer that has the entire blockchain ledger and participates in the verification and validation process 24/7. Block validators are not chosen completely at random. To become a validator, a node must deposit a certain amount of native blockchain tokens in the network as stake. If a node is chosen to validate the next block, it will check the validity of all transactions in the block. If everything is verified, the node signs the block and adds it to the chain of blocks.

The size of the stake determines the chance a validator has in producing the next block. The more tokens you have in the network, the more likely you are to produce a new block. And the more blocks you produce, the more rewards you earn. A validator, also called a “stake pool”, is the equivalent of a representative standing for election in a democratic process and system. Delegators are people who own native tokens (eligible to vote) but who do not operate a node/computer to verify and validate blocks. These delegators can support a representative to generate blocks on their behalf by delegating their tokens and earn rewards accordingly.

The native token (cryptocurrency) of the Cardano ecosystem is called Ada.

To give you an example to better illustrate :

Imagine each « Ada » is like a lottery ticket. To be able to participate in the draw, you must of course have tickets, but also team up with a representative (stake pool) of the protocol. You can choose to become a representative yourself, by operating a stake pool which must be operational and available 24/7. Or you can delegate your tickets to an existing stake pool. When a ticket is a randomly selected, the elected representative gets to generate a block and earn rewards. The rewards are proportionally distributed among the participants (delegators) according to their stake. There is a draw approximately every 10 seconds and tickets are reusable.

It is important to understand that you are not giving away your tickets (Ada) to anyone. The quantity of Ada you have is your weight of influence as a delegator. You can withdraw your Ada and redelegate to another stake pool. You can, of course, also choose to withdraw and sell your Ada at any time, on crypto-currency exchanges.

You should be informed that stale pools have fees, but only on the earned rewards.

You don’t lose your amount of Ada by delegating.

There are two types of fees:

1 – Operational costs, which are set at 340 Adas minimum per epoch (a period of 5 days). This fee is meant to cover the expenses of the stake pool operator (price of the computer, monthly rentals of servers, electricity consumption, marketing, etc.)

2 – The margin fee is defined by the stake pool operator, which is generally between 0 and 10%. The objective of this fee is to reward the efforts of the stake pool operator or finance his/her projects.

The rewards generated minus the fees, over an epoch, are distributed among the participants of the stake pool at the end of the epoch. However, when a representative (stake pool) does not have enough delegation, it is possible that he/she is not elected to verify and validate a block; and no block means no rewards. The number of blocks created by a stake pool is counted every 5 days, this period is called an epoch.

Watch these two videos on blockchain and the three generations by Charles Hoskinson :

https://www.youtube.com/watch?v=97ufCT6lQcY&list=LLUlhxGsDFMsgDw00D-Mhc5A&index=733

https://www.youtube.com/watch?v=Ja9D0kpksxw&t=2s

Why delegate with the « Kurdopia » Stake Pool ?

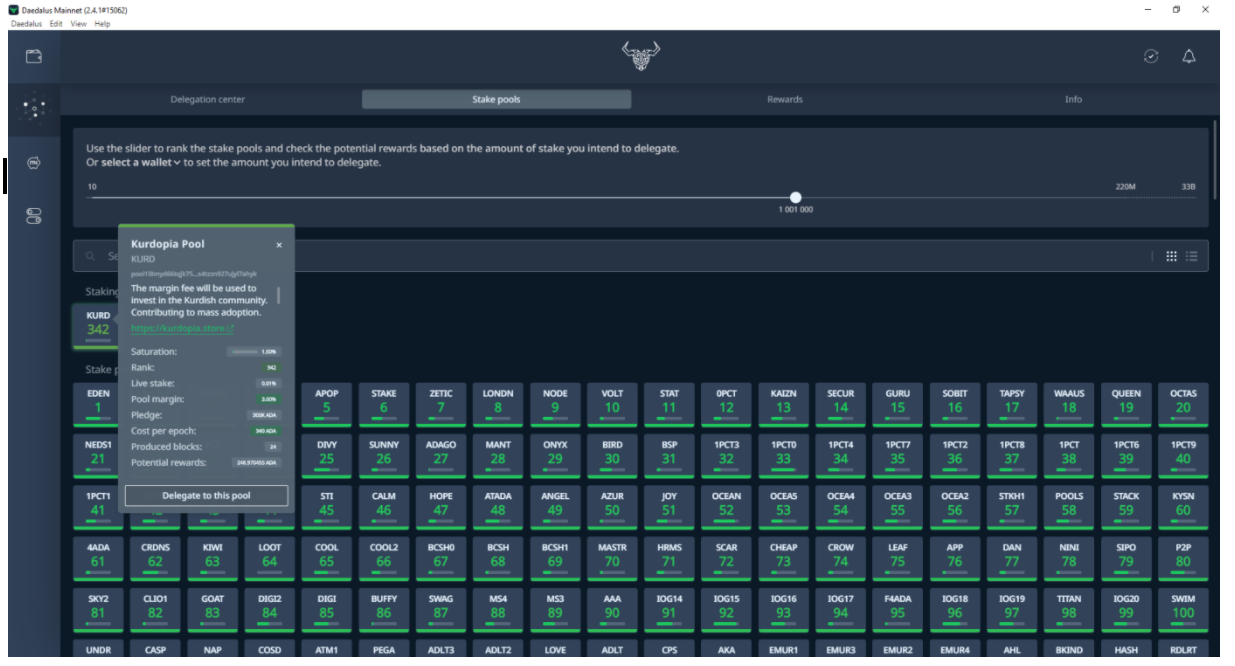

There are now over 1300 stake pools on the Cardano blockchain since the launch of the shelley phase in August 2020. Each stake pool offers its various services, missions or projects. For example, there are stake pools that offer to use their costs to support causes, develop an application or finance their content creation (videos, podcast, articles, etc.).

As we explained at the beginning, our project is to support the Kurdish community. This is what we want to use our fees for (340 ada + 3%). Let’s be clear, you are not giving us your own money, we are offering a « staking » service with which we (and you too) are generating a certain amount of a cryptocurrency (Ada) by participating in the security of the protocol. We tell you how we intend to use our generated funds, that is to say in the service of the Kurdish community. This is our goal and mission. If our Kurdish stake pool is not productive and/or efficient, you can withdraw your delegation at any time, redelegate or cash out. It is without any obligation.

We said that we would present some concrete figures :

Indeed, at the time of writing this article, our stake pool Kurdopia was able to generate a total of 48000 Ada (17280 euros at the current price of 0.36 € per Ada) in about 6 months, with a total of 3.38 million Ada (1,2m €) delegated, currently comprising of 48 delegators, the majority of whom are Kurds. And of course the price of ADA varies, and will undoubtedly continue to gain in value (+1700% since March 2020, having been at 0.02 € per ada).

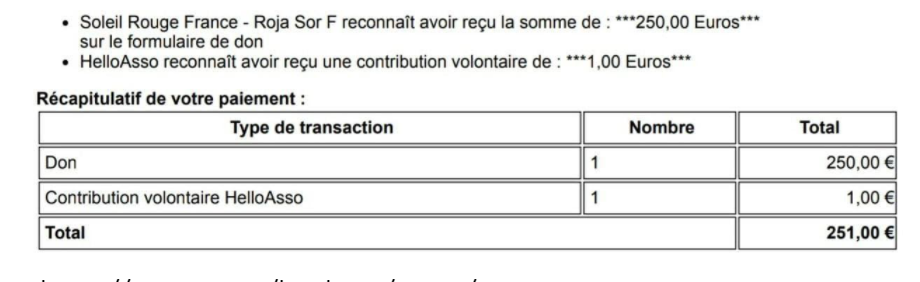

We have already donated a total of 685 euros and 2500 ada on behalf of Kurdopia to four humanitarian causes which you can find here :

- https://twitter.com/kurdopia/status/1325897151218659328?s=20

- https://twitter.com/kurdopia/status/1356755721929584641

Screenshot of the staking interface on the Daedalus desktop wallet of the Cardano blockchain:

Conclusion :

Investing in Cardano is like investing in a company that offers you dividends (a return on your investment) based on your initial investment, which can be as little as 10 or 20 euros. A return on investment between 4-7% or in average 5,5% (in Ada) per year (it’s better than leaving your money in a savings account, isn’t it?). A cryptocurrency with a limited quantity (32 billion tokens in circulation out of the 45 billion max.), which can appreciate in value as its utility and use cases increases.

Imagine if you could buy shares in a start-up that is currently in development. A start-up that will offer a platform for the creation of decentralized applications, such as « google play » but without a central authority. A platform that will include several types of actors. Stake pools are independent players who maintain the network. Each stake pool is like a full-fledged company that earns money by keeping it running smoothly and ensuring the decentralized aspect of the network.

The upcoming players on the Cardano platform are therefore application developers and their users. These actors will therefore bring with them the real value and utility to the platform. This will therefore increase the price of Ada, which will benefit the stake pools and their delegators who ensure the stability of the ecosystem’s infrastructure.

Above all, do not be afraid of the word « invest ». One can’t do anything without investing. « Investing » has a broader meaning than you might imagine, that we are not taught in school. Starting your own business is an investment, learning another language or taking a training course are also investments. Working hard by doing overtime to gain experience or hoping for a promotion is also an investment. We make investments daily without thinking about it or saying the word.

Obviously, investing in a cryptocurrency comes with risk, but just like any other investment. The higher the risk, the greater the reward. However, one must not get things confused, we are not « gambling », we are investing and taking part in a new technology that could revolutionize the financial sector, the internet and thus our lives. It is a calculated and thought through investment with considered risk, which may be worth it.

Of course, we are aware that Kurds are mostly considered as anti-capitalists, the older generation in any case. However, capitalism is not the fact of being rich, capitalism is the fact of being rich for oneself, the fact of being rich at the expense and exploitation of others, it is egocentrism. This is not what we are offering you. We wish you to be rich for yourself (why not?) but above all for the good of your community. Altruism quite the opposite of egocentrism.

What other nation is better suited to make use of a decentralized banking or voting system ?

For more information or the steps to take to participate in the project, you can contact us by email kurdopia.store@gmail.com or on any of the social media sites :

Twitter : https://twitter.com/kurdopia?s=20

Facebook : https://www.facebook.com/Kurdopia.store

Instagram : https://www.instagram.com/kurdopia

Telegram : https://t.me/joinchat/DsNKJhhjmiVoqrfTIGh1zQ

There is our Kurdopia Stake Pool presentation video :

https://www.youtube.com/watch?v=gvdJwR2cusU

This is not financial advice, do your own research before investing any money in cryptocurrencies or other investment projects. Don’t invest more than you can afford to lose.